Straightforward business current accounts at no monthly cost to get started for sole traders, consultants and contractors

Straightforward business current accounts at no monthly cost to get started for sole traders, consultants and contractors

Straightforward business current accounts at no monthly cost to get started for sole traders, consultants and contractors

We pay the incorporation fee on your behalf and give you a free business account

We pay the incorporation fee on your behalf and give you a free business account

We pay the incorporation fee on your behalf and give you a free business account

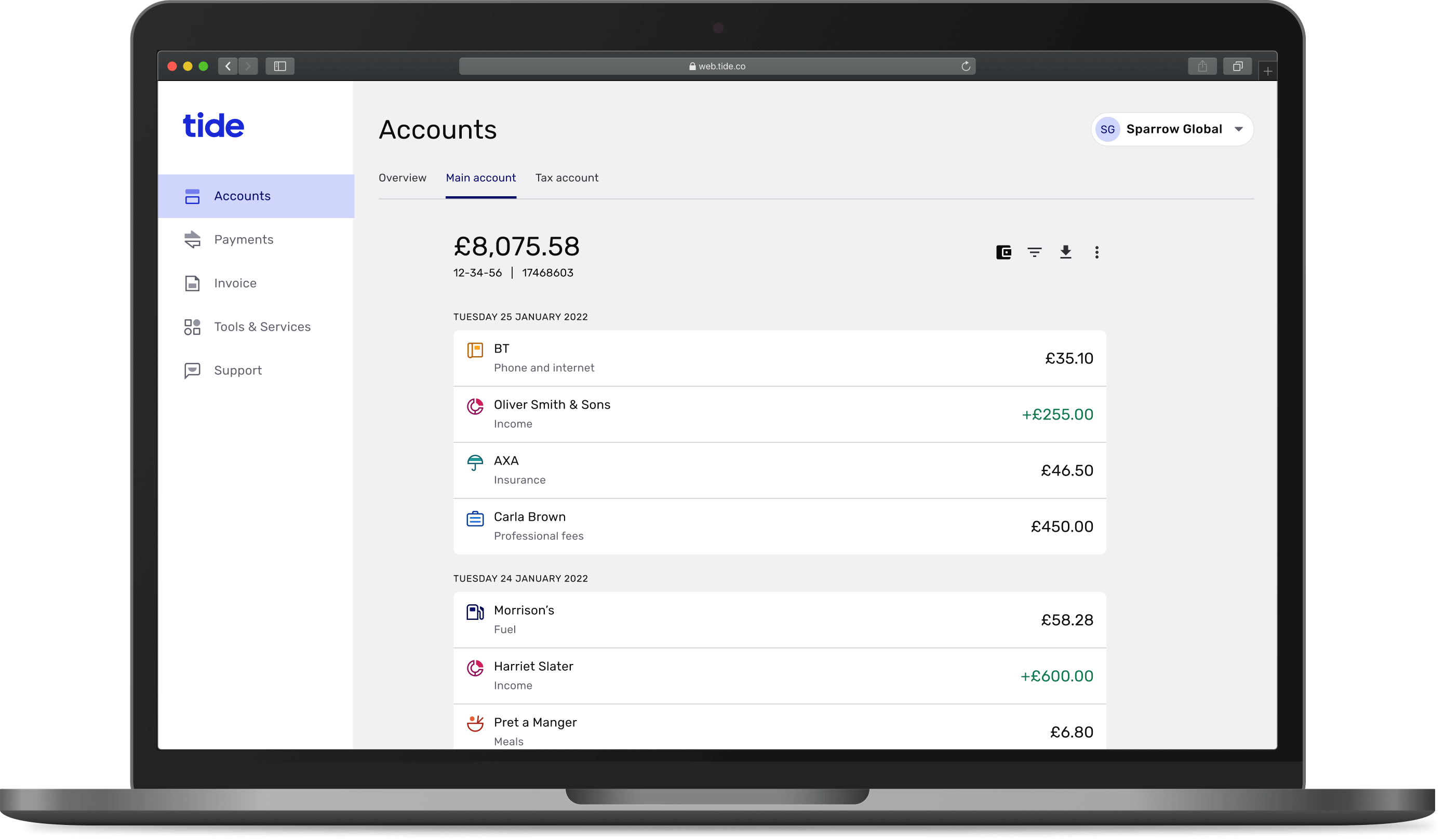

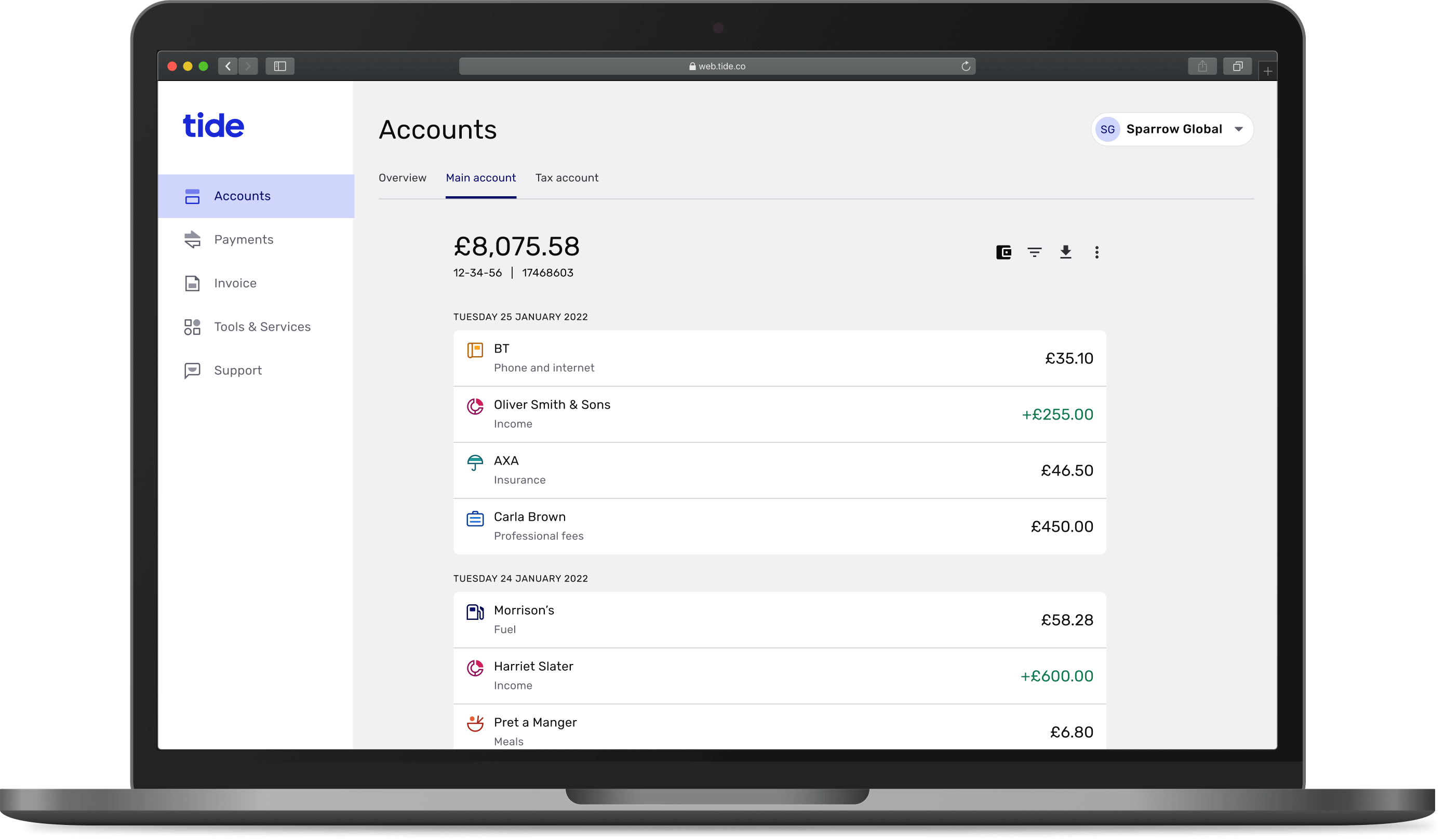

Our business current account is packed with features which save you time and money:

We automatically tag your income and spending. Customise the labels to suit your company.

Upload receipts, auto-match them to transactions, add a note if you like and it’s all stored digitally.

Link your account to software like Xero, QuickBooks, Sage and more.

No need for a separate system, keep on top of your invoices directly in our app.

Manage your finances in a way that works for you, whether it’s in the palm of your hand, or from your computer.

Invite business partners, colleagues or your accountant to view and download transactions.

Download all your payments, attachments and notes, then upload them to any accounting software.

Forget uploading CSVs – connect your account to Xero, QuickBooks, FreeAgent, Sage, KashFlow and Reckon.

Our business current account is packed with features which save you time and money:

We automatically tag your income and spending. Customise the labels to suit your company.

Upload receipts, auto-match them to transactions, add a note if you like and it’s all stored digitally.

Link your account to software like Xero, QuickBooks, Sage and more.

No need for a separate system, keep on top of your invoices directly in our app.

Get a sort code and account number in minutes.

Get a sort code and account number in minutes.

Get a sort code and account number in minutes.

If you’re the director of a company registered with UK Companies House, you’ll be eligible for a Registered Business account. UK-based sole traders and freelancers with a valid UK residential address who are registered with HMRC are eligible for a Sole Trader account.

For both account types, you’ll need to be aged 18 or above, have a valid UK phone number, and hold a device registered to a UK App or Google Play store.

We’re on a mission to help business owners spend less time on money admin.

However, there are a number of high risk industries that we can’t take on, as this would mean not being able to focus our time and energy on the rest of our members.

As a result and going forwards, we will not be offering current accounts to businesses in the following industries

If you’re the director of a company registered with UK Companies House, you’ll be eligible for a Registered Business account. UK-based sole traders and freelancers with a valid UK residential address who are registered with HMRC are eligible for a Sole Trader account.

For both account types, you’ll need to be aged 18 or above, have a valid UK phone number, and hold a device registered to a UK App or Google Play store.

We’re on a mission to help business owners spend less time on money admin.

However, there are a number of high risk industries that we can’t take on, as this would mean not being able to focus our time and energy on the rest of our members.

As a result and going forwards, we will not be offering current accounts to businesses in the following industries

If you’re the director of a company registered with UK Companies House, you’ll be eligible for a Registered Business account. UK-based sole traders and freelancers with a valid UK residential address who are registered with HMRC are eligible for a Sole Trader account.

For both account types, you’ll need to be aged 18 or above, have a valid UK phone number, and hold a device registered to a UK App or Google Play store.

We’re on a mission to help business owners spend less time on money admin.

However, there are a number of high risk industries that we can’t take on, as this would mean not being able to focus our time and energy on the rest of our members.

As a result and going forwards, we will not be offering current accounts to businesses in the following industries

If you’re the director of a company registered with UK Companies House, you’ll be eligible for a Registered Business account. UK-based sole traders and freelancers with a valid UK residential address who are registered with HMRC are eligible for a Sole Trader account.

For both account types, you’ll need to be aged 18 or above, have a valid UK phone number, and hold a device registered to a UK App or Google Play store.

We’re on a mission to help business owners spend less time on money admin.

However, there are a number of high risk industries that we can’t take on, as this would mean not being able to focus our time and energy on the rest of our members.

As a result and going forwards, we will not be offering current accounts to businesses in the following industries

If you’re the director of a company registered with UK Companies House, you’ll be eligible for a Registered Business account. UK-based sole traders and freelancers with a valid UK residential address who are registered with HMRC are eligible for a Sole Trader account.

For both account types, you’ll need to be aged 18 or above, have a valid UK phone number, and hold a device registered to a UK App or Google Play store.

We’re on a mission to help business owners spend less time on money admin.

However, there are a number of high risk industries that we can’t take on, as this would mean not being able to focus our time and energy on the rest of our members.

As a result and going forwards, we will not be offering current accounts to businesses in the following industries

If you’re the director of a company registered with UK Companies House, you’ll be eligible for a Registered Business account. UK-based sole traders and freelancers with a valid UK residential address who are registered with HMRC are eligible for a Sole Trader account.

For both account types, you’ll need to be aged 18 or above, have a valid UK phone number, and hold a device registered to a UK App or Google Play store.

We’re on a mission to help business owners spend less time on money admin.

However, there are a number of high risk industries that we can’t take on, as this would mean not being able to focus our time and energy on the rest of our members.

As a result and going forwards, we will not be offering current accounts to businesses in the following industries

If you’re the director of a company registered with UK Companies House, you’ll be eligible for a Registered Business account. UK-based sole traders and freelancers with a valid UK residential address who are registered with HMRC are eligible for a Sole Trader account.

For both account types, you’ll need to be aged 18 or above, have a valid UK phone number, and hold a device registered to a UK App or Google Play store.

We’re on a mission to help business owners spend less time on money admin.

However, there are a number of high risk industries that we can’t take on, as this would mean not being able to focus our time and energy on the rest of our members.

As a result and going forwards, we will not be offering current accounts to businesses in the following industries

If you’re the director of a company registered with UK Companies House, you’ll be eligible for a Registered Business account. UK-based sole traders and freelancers with a valid UK residential address who are registered with HMRC are eligible for a Sole Trader account.

For both account types, you’ll need to be aged 18 or above, have a valid UK phone number, and hold a device registered to a UK App or Google Play store.

We’re on a mission to help business owners spend less time on money admin.

However, there are a number of high risk industries that we can’t take on, as this would mean not being able to focus our time and energy on the rest of our members.

As a result and going forwards, we will not be offering current accounts to businesses in the following industries

Tide is about doing what you love. That’s why we’re trusted by 450,000+ sole traders, freelancers and limited companies throughout the UK.

Get started

Business current accounts

Published February 2023

As part of a regulatory requirement, an independent survey was conducted to ask approximately 1,200 customers of each of the 15 largest business current account providers if they would recommend their provider to other small and medium-sized enterprises (SMEs*). The results represent the view of customers who took part in the survey.

View full survey results